Let Our Certified Financial Advisors Help You Live Out Your Retirement Dreams

Welcome to Texas Retirement Strategies

We’ll Plan for the Whole Journey, Together.

Texas Retirement Strategies is an end-to-end map of your financial future and how to navigate what’s ahead. It’s our team’s process that makes the magic along the way, accommodating your style with the right level of detail and communication you deserve.

Discovery

Start with your goals & values

- Establish what you need from an advisor

- Map out your current financial picture

Strategy

Evaluate what is needed to reach your goals

- Review of red flags and opportunities

- A strategic plan to get you where you want to go

Implementation

Put your plan to work

- Organize accounts to goals-based investments

- Complete additional planning areas

- Establish our plan for communication and connection

Start By Knowing Where You Are

Knowing your Financial Profile can help you decide the next steps on your wealth journey.

Don’t know where to begin? Start by understanding where your current plan is strong and where there’s opportunity for improvement.

Schedule A Complimentary Consultation TodayWhat Can You Expect?

We’ve built a custom financial planning experience that meets you where you are.

- A Values-Driven Financial Strategy

- Solutions for Turning Assets into Income

- Confidence about Your Retirement Future

- Clarity to Make Today’s Decisions

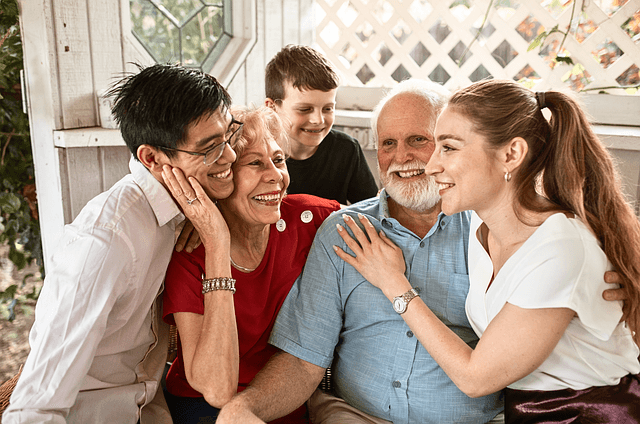

Texas Retirement Solutions is about family.

We put relationships first—let’s talk about what matters most to yours.

Contact Us Today

Why Work With Me?

Clear answers. No pressure. Local expertise. I explain your options in plain English, help you avoid costly mistakes, and listen first.